IronFlow Capital

Built for Real Traders — Not Gimmicks

IronFlow Capital is dedicated to helping traders achieve verified success through prop firm compliance, disciplined risk control, and structured growth.

At IronFlow Capital, every model, setup, and journal process is designed around real evaluation rules and live account requirements.

Our members focus on:

Passing Prop Firm Evaluations with consistency and precision.

Maintaining Compliance with live Performance Account (PA) rules.

Building Long-Term Equity by trading multiple PA accounts responsibly.

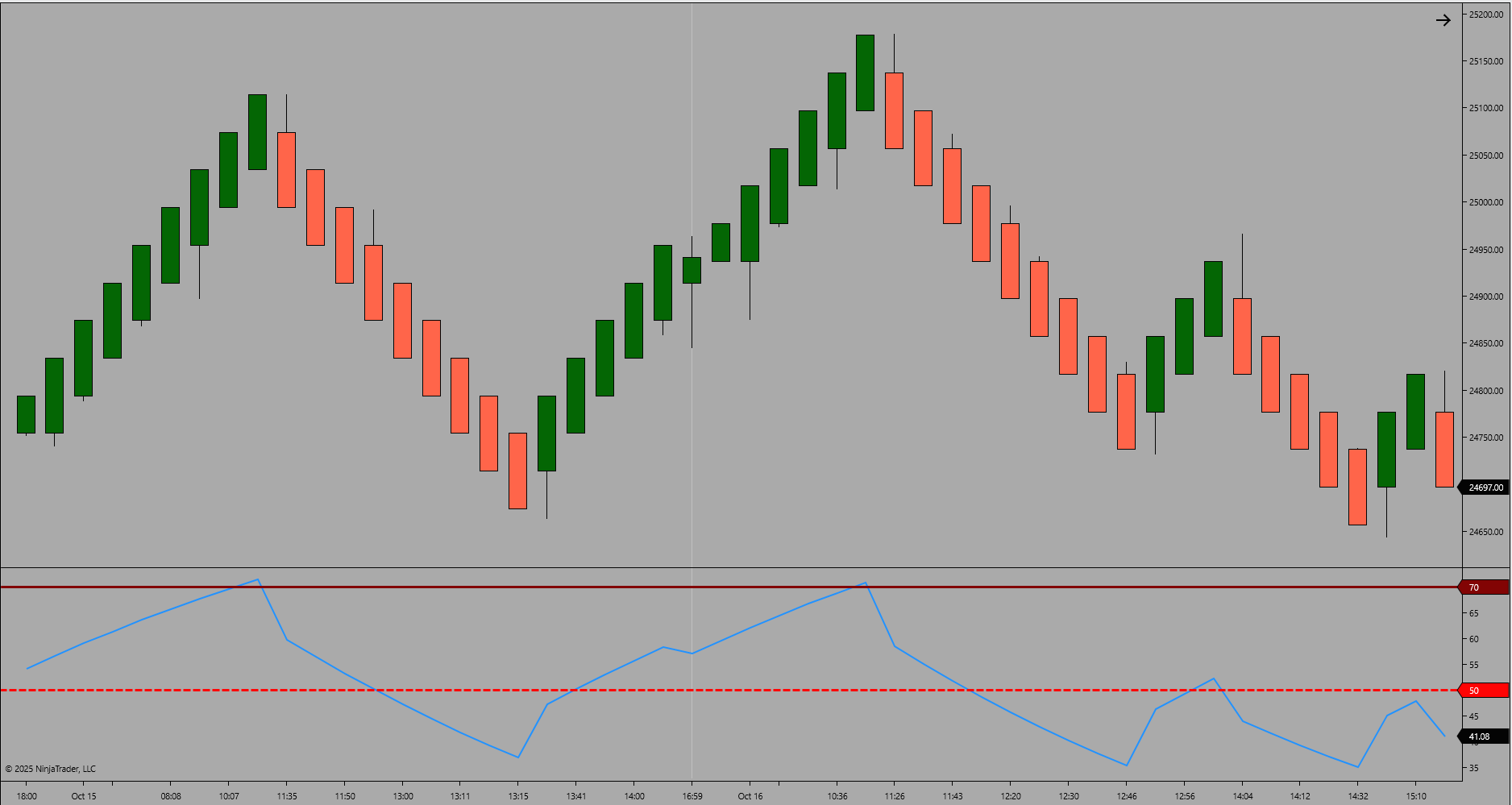

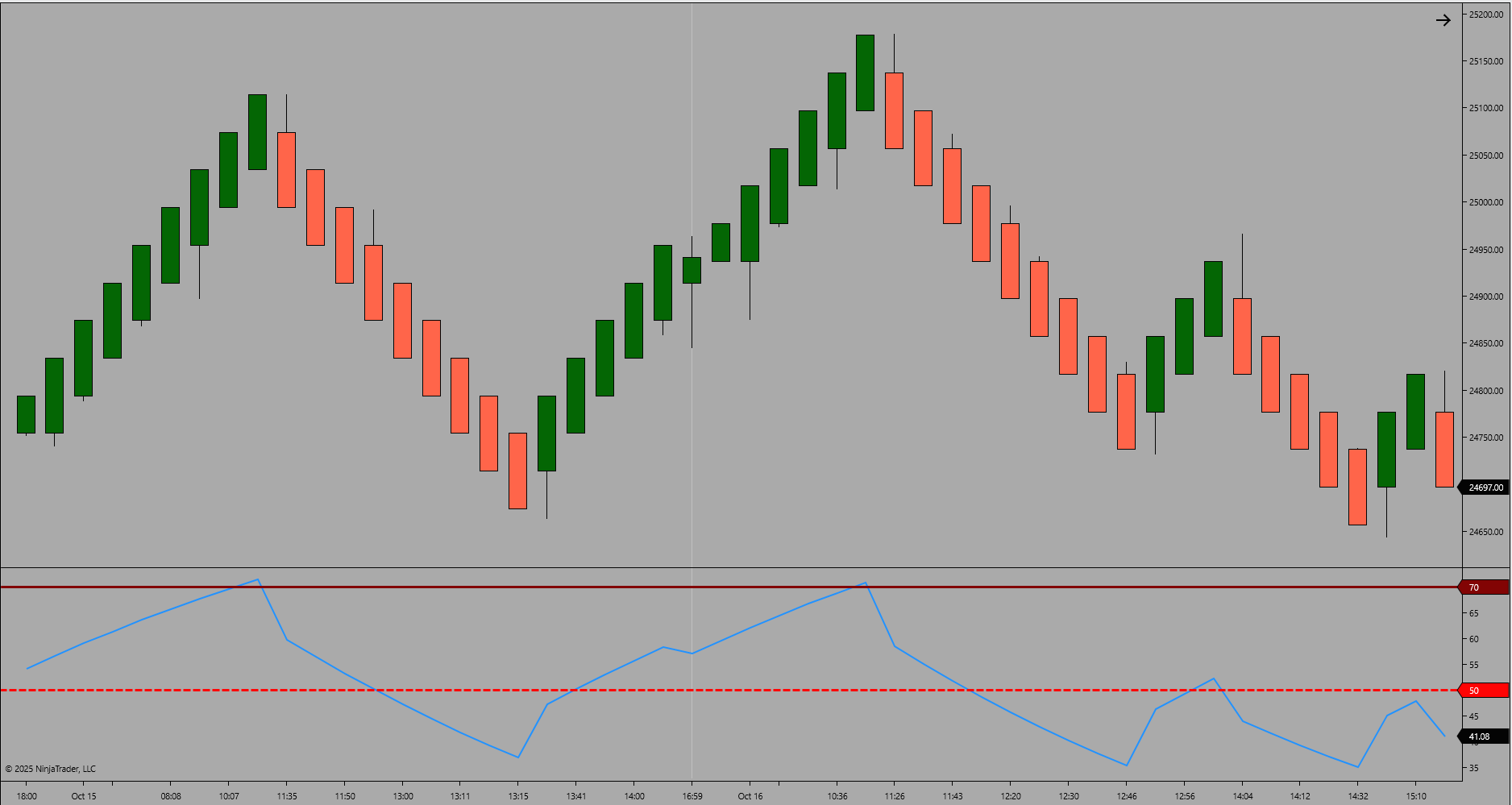

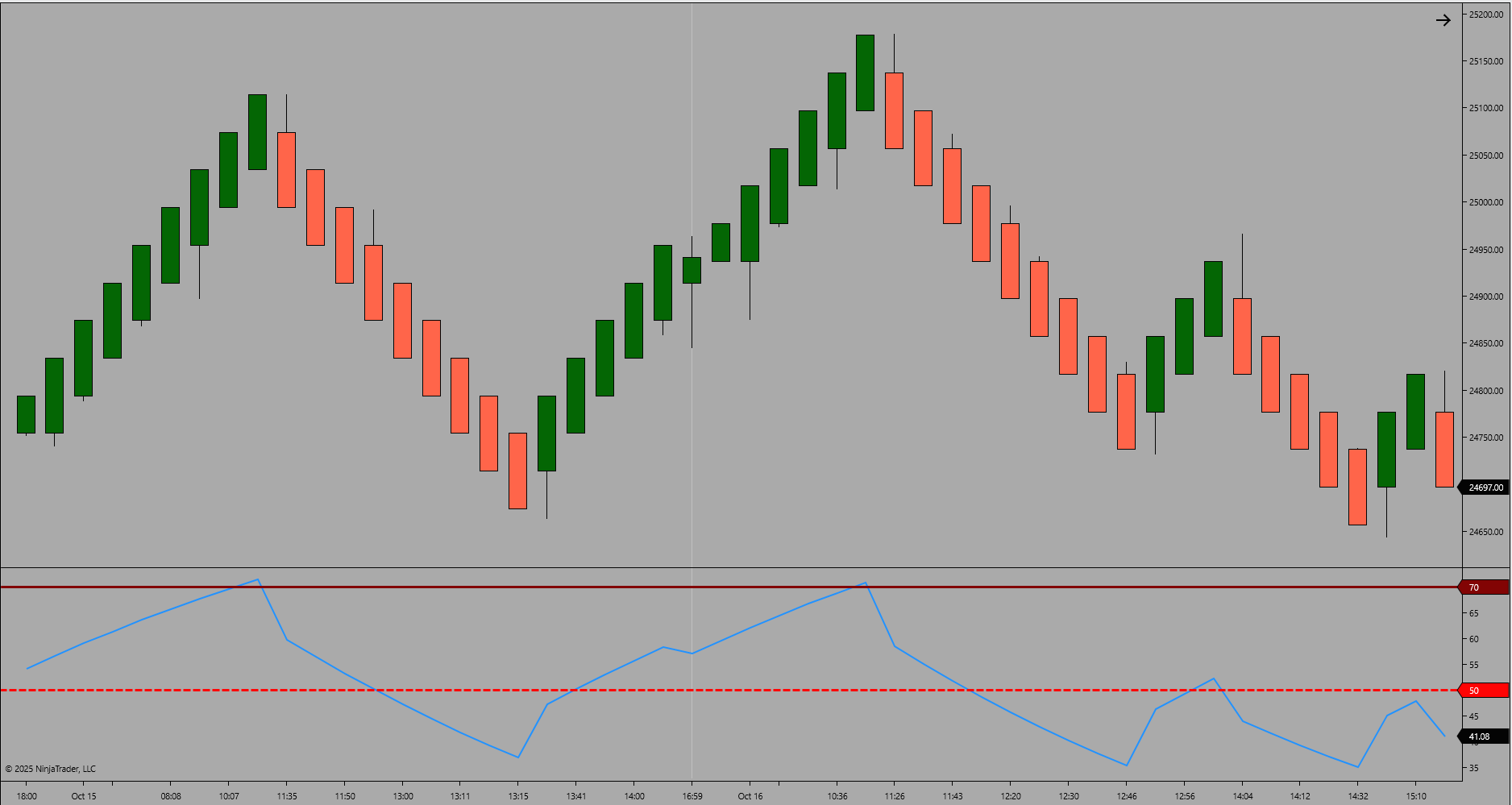

IronFlow Capital Structural RSI Framework™

A complete system for understanding how market structure and momentum interact across timeframes.

Trade with clarity and confidence. The IronFlow Capital Structural RSI Framework provides a structured method for reading price flow, identifying momentum transitions, and aligning direction across the NQ futures market.

Structure is the Language of the Market

The Structural RSI Framework explains how price rhythm and momentum create opportunity. By combining structure alignment with momentum confirmation, traders can identify the core flow of the market rather than reacting to short-term noise.

Structure and Momentum Relationship

This concept explains how price structure and market rhythm interact to shape directional movement. By studying how expansion, compression, and continuation phases form within price flow, traders can better understand market behavior and improve timing and bias awareness without relying on any specific indicator or proprietary system.

Learn Through the Official IronFlow Capital Publications

Each IronFlow Capital book expands on a specific part of the Structural RSI Framework. The Playbook focuses on momentum and structure alignment, while The Reversal Playbook applies the framework to turning points and transition patterns.